…What are the effects of high-interest rates?

…Historically, rises in market interest rates have been accompanied by cries of pain from borrowers, including industry, complaining about the cost of loans and bonds.

…In fact, a large portion of the Nigerian financial services industry manages liquidity (as opposed to issuing debt) and stands to benefit.

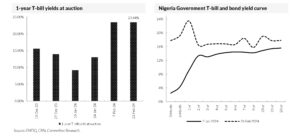

TUE, FEB 27 2024-theGBJournal|There has been a significant rise in T-bill rates, and it looks like these will be sustained for some time.

Historically, rises in market interest rates have been accompanied by cries of pain from borrowers, including industry, complaining about the cost of loans and bonds.

This is only half the story. Loans and bonds are largely sourced from deposits and savings, so there are many beneficiaries of high-interest rates.

To begin with, Nigeria’s pension funds are set to earn substantially more from their holdings of T-bills and FGN bonds than they have done for many years (see the T-bill yield chart).

Next, mutual fund holders stand to gain as Money Market mutual funds offer meaningful competition to bank deposits. Long-term Naira savers may increase their holdings in Fixed Income mutual funds, too.

In fact, a large portion of the Nigerian financial services industry manages liquidity (as opposed to issuing debt) and stands to benefit. The opposite might be said of banks, which have to pass on the rising cost of money to their lending customers, but in this case it is lending customers that bear the brunt of interest rate rises.

Banks in these circumstances can benefit from widening the spread between deposits and customer loans. And they typically receive an allocation of T-bills at auction and sell

them into a willing market.

Note that the CBN, which strongly influences T-bill rates via its regular auctions, has not raised the 1-year T-bill rate above the level of inflation (headline inflation is 29.9% pa), presumably because it believes that interest rates above the level of inflation are not necessary to bring inflation down, especially as it also curtails its ways and means loans to the government.

The government suffers as its financing costs (the interest on T-bills and FGN bonds)rise.

As expected, the Monetary Policy Council (MPC) of CBN did raise the Monetary Policy Rate (MPR) by 400 basis points to 22.75% (initial forecast of 100 basis points (bps) to 19.75%) at the conclusion of its meeting on Tuesday.

This is an emphatic signal of its intention to create price stability after four years of rising inflation.

In terms of investor behavior, we expect this to change markedly if market interest rates (we use 1-year T-bill rates as a reference point) stay at 20.0% pa or more.

Risk has been in fashion for four years since T-bill rates crashed in late 2019. Witness

the stock market returns since then (2020: +50%; 2021: +6%; 2022 +20%; 2023: +46%).

We still expect a positive return from the NGX All-Share Index this year, but we also expect investors to return to fixed-income instruments (T-bills, commercial paper, FGN bonds, corporate bonds).

Finally, what of inflation? Inflation imposes a terrible cost on the consumer (food inflation is 35.4% per annum). Most consumers do not hold significant savings and will not benefit from rising interest rates.

The transition from high inflation, via high-interest rates, to low inflation is likely to be a painful one. But low inflation is the most desirable outcome for households, in our view.-By Coronation Research (Nigeria Weekly Update)

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com