…What is the point of companies paying dividends? Why do they do it, and what is the point of these annual, and sometimes semi-annual, payments to shareholders?

…The answer from the companies’ point of view is easy enough

FRI APRIL 12 2024-theGBJournal|Over the past four years the NGX Exchange’s All-Share Index has delivered exceptional returns.

Despite this, Nigerian pension funds have low allocations to equities and investors in Nigerian mutual funds are no more enthusiastic. The reason, in our view, has to do with the volatility of equity returns and the fact that, for several years before 2020, the NGX All-Share Index delivered negative returns.

Is there a selection of NGX-listed equities that delivers superior returns, and can beat inflation, over the long term? Our study, which builds on our earlier publication Equity for a Superior Return, 5 November 2021, shows that there is.

If we strictly adhere to a selection of NGX-listed equities that consistently show high profitability (our benchmark is a consistent Return on Equity of over 20.5% per annum) and that pay dividends, we arrive at a portfolio of equities that, between 1 January 2016 and the end of 2023, consistently beat inflation, as well as beating Naira fixed income returns.

This calls for a new dialogue between long-term equity investors, including pension funds, and the NGX-listed companies that consistently deliver high shareholder returns and pay dividends. Committed long-term investors should own them, in our view.

What is the point of companies paying dividends? Why do they do it, and what is the point of these annual, and sometimes semi-annual, payments to shareholders? The answer from the companies’ point of view is easy enough. Companies must reward their shareholders for their investment in cash as well as stock price appreciation. Dividend payments cannot be guaranteed but management needs to make best efforts to ensure that dividends are paid regularly.

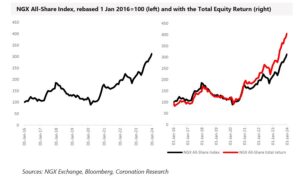

What are dividends worth to shareholders, over the long term? Our answer is, quite simply, ‘a lot’. The charts below show the NGX All-Share Index over eight years, 2016 – 2023 inclusive, and compare its performance with the Total Equity Return.

The Total Equity Return is calculated by taking all the NGXlisted companies’ dividends and reinvesting them in the same companies that pay them. Reinvestments are made soon after dividend payment dates.

The NGX All-Share Index returned 212.7% over this period, giving an eight-year compound annual growth rate (CAGR) of 15.3%. The Total Equity Return was considerably better, a return of 304.6% over eight years, a CAGR of 19.1%.

These differences in performance matter a great deal when considering whether to invest in equities or not, and when assessing whether Nigerian equity investments beat investments in Nigerian Treasury Bills (T-bills), Federal Government of Nigeria (FGN) bonds, and whether they compensate for the effects of inflation.

At this point, it could be objected that T-bill and FGN returns have recently become much better than at any point over the part four years (2020 – 2023, inclusive) and that we should not be talking about equities just because they have enjoyed a spectacular four-year bull run.

Our rejoinder is that, while Naira fixed-income returns are much better than they were, they still do not exceed the rate of inflation. Now consider that the NGX All-Share Index Total Equity Return was 24.6% in 2022, which beat inflation, and 54.0% in 2023, which easily beat inflation (by almost double).

Note that for some of the period studied, the Total Equity Return does not materially outperform the simple NGX All-Share Return. A Total Equity Return actually requires an equity market to trend upwards in order to do its job well.

This is because dividends received in cash are reinvested in equities, but if the value of those equities falls then the value of the reinvested dividends also falls: it would have been better to have held onto the cash. It is when markets are trending upwards that Total Equity Returns work.

It can even be the case that, when markets are weak when full-year dividends are paid around April, stocks can be bought cheaply and deliver strong outperformance when the market recovers later in the year. 2020 was a case in point as the NGX All-Share Index returned 50.0% while the Total Equity Return was 62.4%.

In our view, genuinely long-term investors are those that stand to benefit most from investing for total equity returns. Potential candidates are those looking to build up a pension pot and, therefore, Nigerian pension funds. The latter have the advantage of being exempt from withholding tax on dividends and therefore can invest their dividend proceeds gross.

Long-term Equity Investors

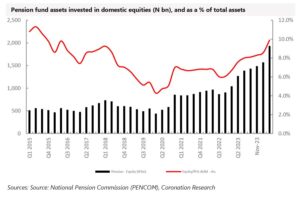

Nigeria’s long-term investors do not appear to have much appetite for equity. Our recent measure of the percentage of Nigerian pension fund assets under management held in equities came in at 8.6% (for the end of January).

This is surprising, given that over the fours years between 2020 – 2023, inclusive, the NGX Exchange’s All-Share Index returned 176.8% (a compound annual growth rate of 29.3%), easily beating inflation, as well as the returns from Federal Government of Nigeria (FGN) bonds and T-bills.

The Total Equity Return (with dividends reinvested) of the NGX All-Share Index over the same period was even better, at 253.3%, a CAGR of 37.1%.

The most likely explanation, in our view, is that equity returns are volatile, meaning that even if they are better than bond and T-bill returns, they are unpredictable, which for a pension fund that needs to keep a close eye on its assets and liabilities, present challenges.

Even then, we reason, there is a case for taking a high proportion of equities when building up capital for future retirees: switching to bonds makes sense when pension fund holders are close to retirement.

Another explanation is that, while the past four years have provided good equity returns, the years before were generally bad, with three of the four years between 2016 – 2019 inclusive, registering negative returns.

Bad memories die hard. This raises the question of whether there is a selection of equities that would give inflation-beating returns over the long term, and the purpose of this report is to identify it.

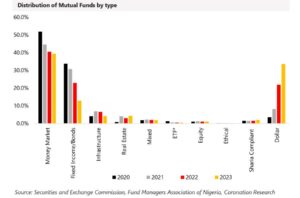

Meanwhile, it is clear that investors in Nigerian mutual funds are no more enthusiastic about equities than Nigerian pension funds. Investors’ allocations to equity funds are minuscule in comparison with their preferred allocations to money market funds, FGN bond funds and US dollar funds.

When it comes to the retail investor, equity funds remain out of fashion despite the performance of the equity market over the past four year and the potential of equities to deliver long-term inflation-beating total equity returns.

High RoE Equities

How should an equity investor construct a portfolio that generates long-term total returns? Our approach, which we described in our publication Equities for a Superior Return, 5 November 2021 is to take equities with the highest return on equity (RoE) available.

Our reasoning is that listed companies with the highest returns on equity, i.e. the most profitable ones, are those most likely to be rewarded with share price performance by the market and are, at the same time, the ones most capable of paying dividends.

Our intention was to find companies that could be identified with reasonable ease, companies that had a long history (starting in 2010) of reporting consistently high RoE. We set our benchmark RoE at 20.5% per annum, this being (at the time) a little way above the rate of inflation and reasonably close to most estimates of the cost of equity (CoE) for companies in Nigeria, which trend in a range between 22.0% -26.0%.

What was very striking was how few NGX-listed companies either achieved or exceeded our benchmark when we set out our study in 2021.

Note that a listed company that occasionally achieves a RoE of 20.0% or more, or one that looked as if was about to, did not interest us: we wanted consistent high RoE generators with a track record.

We identified 11 such listed companies: Dangote Cement; Nestle Nigeria; Guaranty Trust Holding Company (GTCO); Zenith Bank; Stanbic IBTC Holdings; Dangote Sugar; Okomu Oil; Presco; NASCON; Custodian Investment; and MTN Nigeria. We excluded MTN Nigeria in our long-term study of equity returns because it was only listed in 2019. (It is a candidate for inclusion in a future model portfolio of stocks for total equity return.) Our study was agnostic with regards to sector.

The model High RoE Equity portfolio ended up with four financial services companies and two agricultural companies (Okomu Oil and Presco), which would definitely not match the constituents of the NGX Exchange’s All-Share Index, nor any other index or sub-index grouping NGX Exchange-listed companies.

The idea behind our selection of listed equities is simplicity, namely just screening companies for RoE, though in a future study there may be a case for adding Return on Assets (RoA) as a benchmark.

This would shed light on companies, like Nestle Nigeria, that pay a very high proportion of their Net Profits as dividends, a practice that keeps their Retained Earnings low, therefore their Total Shareholders’ Funds low and boosts RoE.

In our publication in November 2021 we made a special mention of Access Holdings, whose long-term RoE was a little beneath our 20.5% threshold but whose long-term Total Returns were on a par with some of the high-RoE companies in our study.

Given that its RoE rose from 13.4% in 2022 to 36.2% in 2023, and if we find that its gains in RoE (or most of its gains in RoE) are sustainable, then it too will join our future High RoE Equity portfolio. Like most bank-based financial services companies, it is a good dividend payer.

So far, we have established that:

a) the NGX All-Share Index return is significantly outperformed by its Total Equity Return, which takes companies’ dividends and invests them in the same equities;

b) it is straightforward to identify a small number of listed companies whose Return on Equity (RoE) trends consistently above our benchmark 20.5% pa.

These are chosen for our model portfolio irrespective of sector or membership of an existing index, or sub-index. We reason that these are the ones most likely to be rewarded with share price performance and the most capable of paying regular dividends.

The next step is to construct a model portfolio of these High RoE Equities and measure their combined Total Equity Return. This is not a portfolio that is reviewed on a regular basis; it is not adjusted; its constituents never change, apart from receiving reinvestment via dividends. Its inception date is 1 January 2016, with a notional N10.0 billion equally invested across our 10 High RoE Equities.

We devised it in November 2021. It is priced monthly. We add back gross dividends by making notional purchases of the equity of the company paying them. Then, quite simply, we see what happens.

The High RoE Equity model portfolio, with dividends reinvested, returned 763.2% over the eight years to the end of 2023, with a compound annual growth rate (CAGR) of 30.9%, easily beating inflation.

The selection of just 10 equities for this portfolio, each with a consistent record of generating RoE in excess of our benchmark 20.5% pa, was a key part of its success. The overall Total Equity Return of the NGX All-Share Index over the same period, for comparison, was 304.6%, with a CAGR of 19.1%.

Can this be true?

Clearly, the above chart raises a few questions. Can this be true? Is it not strange that the line for the High RoE Equity model portfolio suddenly takes off in 2023?

In 2023 the performance of the High RoE Equity model portfolio was strongly influenced by gains in two stocks, Dangote Sugar and NASCON (both of which were there when we began the model portfolio in 2021, with their inception dates at 1 January 2016).

Using our performance attribution model, we can quite simply re-run the portfolio while holding the price of these two stocks constant during 2023. The resulting measurement is that the High RoE Equity model portfolio, with dividends reinvested to produce a Total Equity Return, returned 512.9% over the eight years to the end of 2023, with a CAGR of 25.4%. This beat inflation.

Another way of answering the questions is to look at the returns of the High RoE Equity model portfolio up to the end of 2022 (ie before the take-off in prices of Dangote Sugar and NASCON). During the seven years from 1 Jan 2016 to the end of 2022 it returned 302.0%, with a CAGR of 22.0%, again beating inflation.

Not For the faint-hearted

One of the strange things about investing for the long term is that there are sudden spikes in performance, quite often coming after periods of poor performance. This is, quite simply, volatility. The genuinely long-term equity investor, in our view, might be concerned by volatility but it wise enough not to manage it.

Take the year 2022. In 2022 the High RoE Equity model portfolio, with dividends reinvested, returned just 6.8%. The NGX All-Share Index did considerably better, returning 20.0% that year. It was a bad year for the performance of financial services stocks, particularly banks, and this strongly influenced our model portfolio.

How would a professional fund manager, managing a real-life portfolio based on our High RoE Equity model portfolio, have fared in 2022? Bear in mind that in the real world professional fund managers report to investment committees and to boards, usually quarterly, and a year’s underperformance of the NGX All-Share Index is more than a few blushes: it is difficult to defend.

In the real world we suspect that professional fund managers spend a lot of time managing volatility, as well as trying to maximize returns.

In conclusion, we can demonstrate that investing in High RoE Equities and reinvesting their dividends in the same equities, results in strong outperformance over the long term. But it is not for the faint-hearted.

This Analysis is written by Coronation Research and made available to theG&BJournal

X-@theGBJournal|Facebook-the Government and Business Journal|email:gbj@govbusinessjournal.com|govandbusinessj@gmail.com